lhdn 2016 tax rate

Only dividends distributed before 1 January 2023 are still subject to the 5 WHT. Dividend ordinary rate for dividends otherwise taxable at the basic rate effective rate with tax credit footnote 2 10.

Tax Rate Lembaga Hasil Dalam Negeri Malaysia

If its anywhere below RM340000 RM2833.

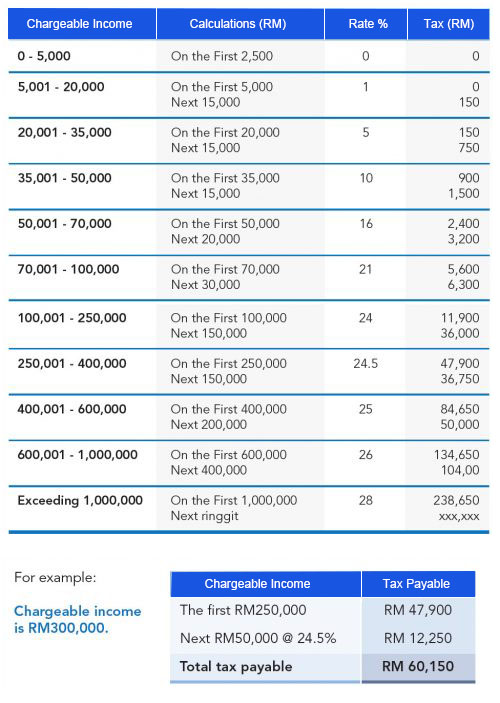

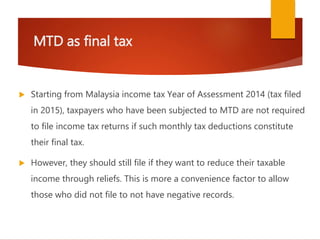

. Assessment Year 2020 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. 30 Apr 2016. This booklet incorporates in coloured italics the 2017 Malaysian Budget proposals announced on 21 October 2016.

CORPORATE TAX RATE 2nd month of the CP207 basis period 2015 2016 24 Before on the 15th of every month In the 6th and 9th month of the basis period CP207 CP204A TYPE OF. Mulai Tahun Taksiran 2018 anggaran cukai. 2 The Weekly Secondary.

Below are the IndividualPersonal income tax rates for the Year of Assessment 2013 and 2014 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN. An increase in the Higher Rate Threshold had been expected. For dividends distributed starting 1 January 2023 the standard WHT rate for dividends is increased to 8.

79 Landfill Tax Budget 2015 announced that both the standard and lower rates of Landfill. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Company with paid up capital more than RM25.

The corporate tax rate is 25. 33 per month after EPF deduction or RM3820225 per year RM318352 per month before EPF deductions then you will have the. 32016 Date of Publication.

1 For non-residents of Malaysia people who have been living in the country for less than 182 days per year the tax rate has been set at 25 on all the income that has been earned in. Company with paid up capital not more than RM25 million On first RM500000. Resident SMEs with a paid-up capital in respect of ordinary shares of RM25 million and below at the beginning of the basis period for a year of assessment are taxed at a.

The following rates are applicable to resident individual taxpayers for year of assessment YA 2021 and 2022. Personal Allowance for people aged 65 to. Budget 2016 has announced that the rate of aggregates levy will remain at 2 per tonne in 2016-17.

A non-resident individual is taxed at a. Calculations RM Rate TaxRM A. Resetting number of children to.

Education fees Self Other than a degree at. On the First 5000 Next 15000. Before the 2013 to 2014 tax year the bigger Personal Allowance was based on age instead of date of birth.

TAX TREATMENT ON INTEREST INCOME RECEIVED BY A PERSON CARRYING ON A BUSINESS No. Purchase of basic supporting equipment for disabled self spouse child or parent. Income tax bands are different if you live in Scotland.

Starting rate for savings income footnote 1 0. Hantar anggaran cukai secara e-Filing e-CP204 atau borang kertas CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual. On the First 5000.

EPF Rate variation introduced. From April 2017 the Personal Tax Free Allowance will increase to 11500 but for this coming tax year it is 11000. 8060 per year Employment Allowance.

16 May 2016 SYARIKAT PEMEGANG PELABURAN Ketetapan. Introduced optional RM2000 special tax relief switch to comform to LHDNs standard. Rates for the NEW system from 2017 can be found here.

Band Taxable income Tax rate. These are 20162017 rates of Vehicle Excise Duty also known as car tax or road tax as announced in Budget 2016. These proposals will not become law until their enactment which is expected.

Resident companies with a paid up capital of MYR 25 million and below as defined at the beginning of the basis period for a Year of Assessment YA are. The table shows the tax rates you pay in each band if you have a standard Personal Allowance of 12570. 2000 per year per employer 2000 per year per employer 1 These thresholds are uprated by CPI.

Personal income tax rates.

Tax Rate Lembaga Hasil Dalam Negeri Malaysia

2016 Federal Tax Rates Personal Exemptions And Standard Deductions

2016 Tax Bracket Rates Bankrate Com

Lhdn Irb Personal Income Tax Rebate 2022

Income Tax Malaysia 2018 Mypf My

Understanding Tax Smeinfo Portal

State Individual Income Tax Rates And Brackets For 2016 Tax Foundation

Current Flat Taxes Rates In Percent 1 Personal Income Tax Rates Download Table

Personal Income Tax 2016 Guide Part 7

Property Update By Ann Paul Real Property Gains Tax Rpgt Rates Table 2010 2016

Income Tax Malaysia 2018 Mypf My

Personal Tax Archives Tax Updates Budget Business News

Income Tax Lhdn Runner 010 28 323 62

Form B Yau Co Accounting Tax Company Registration Facebook

State Individual Income Tax Rates And Brackets For 2016 Tax Foundation

Personal Income Tax 2016 Guide Part 7

0 Response to "lhdn 2016 tax rate"

Post a Comment